Mynd:UK tax NIC percentages.svg

Úr SignWiki

Jump to navigation

Jump to search

Stærð þessarar PNG forskoðunar á SVG skránni: 512 × 384 mynddílar. Aðrar upplausnir: 320 × 240 mynddílar | 640 × 480 mynddílar | 800 × 600 mynddílar | 1.024 × 768 mynddílar | 1.280 × 960 mynddílar.

Upphafleg skrá (SVG-skrá, að nafni til 512 × 384 mynddílar, skráarstærð: 220 KB)

Skrá þessi er af Wikimedia Commons, og deilt meðal annarra verkefna og nýtist því þar. Hér fyrir neðan er afrit af skráarsíðunni þar.

Efnisyfirlit

Lýsing

| LýsingUK tax NIC percentages.svg |

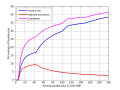

English: Charges to w:UK income tax and w:National Insurance as a percentage of taxable/NICable pay for the tax year 6 April 2010 thru 5 April 2011. This takes account only of straightforward income tax and Class I employee NICs without contracted-out pension contributions.

Made in w:MATLAB and finished with w:Inkscape. See below for MATLAB source. According to w:HMRC, the tax and National Insurance rates and allowances for 2010/11 are [1]:

|

| Dagsetning | |

| Uppruni | eigin skrá |

| Höfundarréttarhafi | Splash |

| Réttindi (Endurnotkun á þessari skrá) |

See below. Licensing choices are applicable to both image and MATLAB source code. |

| SVG genesis InfoField | |

| Source code InfoField | MATLAB codefunction [it_pounds, it_pct, nic_pounds, nic_pct, total_pounds, total_pct, takehome_pounds] = tax(gross, tax_rates, tax_widths, claw_start, claw_rate, nic_rates, nic_widths, plot_all)

%TAX: Compute the pounds and percentage cost of taxable pay of income tax

%and National Insurance. (Or just tax in places without NI).

%

%[it_pounds it_pct nic_pounds nic_pct total_pounds total_pct takehome_pounds] = tax(gross, tax_rates, tax_widths, nic_rates, nic_widths, plot_all)

%

%Inputs:

% GROSS: Vector of taxable pay amounts to compute all outputs for.

% TAX_RATES: Percentages of tax rates matching entries in tax_widths.

% TAX_WIDTHS: Width in pounds of each tax band, ended by Inf. NOT the

% income levels at which they begin to apply. For example, for 2007-08:

%

% Personal allowance, or 0% band = £5225.

% 10% band = First £2230 taxable = £2230 in width.

% 22% band = £2230 - £34600 taxable = £32370 in width.

% 40% band = £34600 - (unlimited) taxable = £Inf in width.

%

% Therefore, tax_rates and tax_widths are set up as follows:

%

% TAX_RATES = [ 0 10 22 40];

% TAX_WIDTHS = [5225 2230 32370 Inf];

%

% CLAW_START: Value of GROSS at which the clawback of personal allowance

% starts.

% CLAW_RATE: A 2-vector, [PER STEP], where PER is the clawback for each

% increment in GROSS of STEP. E.g. a clawback of £1 for every £2 of GROSS

% is expressed as CLAW_RATE = [1 2].

%

% NIC_RATES: As TAX_RATES. (Omit if no NIC-equivalent needed).

% NIC_WIDTHS: As TAX_WIDTHS. (Omit if no NIC-equivalent needed).

% PLOT_ALL : Single boolean true/false whether to draw the output plot.

%

%Outputs:

% These all have obvious names, and each produce a vector with entries

% corresponding to the entries of input GROSS.

for g = 1:length(gross)

it_pounds(g) = tax_calc(gross(g), tax_rates, tax_widths, claw_start, claw_rate);

it_pct(g) = 100*it_pounds(g)/gross(g);

nic_pounds(g) = tax_calc(gross(g), nic_rates, nic_widths);

nic_pct(g) = 100*nic_pounds(g)/gross(g);

total_pounds(g) = it_pounds(g) + nic_pounds(g);

total_pct(g) = 100*total_pounds(g)/gross(g);

takehome_pounds(g) = gross(g) - total_pounds(g);

end

if exist('plot_all', 'var') && plot_all

%Plots for amounts in pounds

figure;

plot(gross, it_pounds, 'b', gross, nic_pounds, 'r', gross, total_pounds, 'm', gross, takehome_pounds, 'g');

set(get(gca, 'Children'), 'LineWidth',2);

set(gca, 'XMinorTick', 'off', 'YMinorTick', 'on');

legend('Income tax', 'National insurance', 'Combined', 'Take home');

xlabel('Annual taxable pay, GBP');

ylabel('Annual amount, GBP');

grid on;

%Plots for percentages

figure;

plot(gross, it_pct, 'b', gross, nic_pct, 'r', gross, total_pct, 'm');

set(get(gca, 'Children'), 'LineWidth',2);

set(gca, 'XMinorTick', 'off', 'YMinorTick', 'on');

legend('Income tax', 'National insurance', 'Combined');

xlabel('Annual taxable pay, GBP');

ylabel('Percentage of taxable pay');

grid on;

end

%%%%Calculation engine%%%%

function total_tax = tax_calc(gross, rates, widths, claw_start, claw_rate)

tax_band = 1;

income_left = gross;

total_tax = 0;

%Clawback if necessary

if exist('claw_start', 'var') && exist('claw_rate', 'var')

widths(1) = clawback(gross, claw_start, claw_rate, widths(1));

end

while tax_band <= length(widths) && income_left > 0

taxable_this_band = min([widths(tax_band) income_left]);

total_tax = total_tax + taxable_this_band*rates(tax_band)/100;

income_left = income_left - taxable_this_band;

tax_band = tax_band + 1;

end

function new_limit = clawback(gross, claw_start, claw_rate, initial_limit)

%GROSS: Vector of taxable pay amounts to compute all outputs for.

%CLAW_START: Values of GROSS at which the clawback starts

%CLAW_RATE: A 2-vector, [PER STEP], where PER is the clawback for each

%increment in GROSS of STEP. E.g. a clawback of £1 for every £2 of GROSS

%is expressed as CLAW_RATE = [1 2].

%INITIAL_LIMIT: The un-clawedback value to begin with.

%

%NEW_LIMIT is the clawed-back value of INITIAL_LIMIT.

claw_length = max(gross - claw_start, 0);

claw = claw_rate(1) * floor(claw_length/claw_rate(2));

new_limit = max(initial_limit - claw, 0);

</source>

;For the 2010-11 tax year:

<source lang="matlab">

tax_rates = [0 20 40 50];

tax_widths = [6475 37400 112600 Inf];

claw_start = 100000;

claw_rate = [1 2];

nic_rates = [0 11 1];

nic_widths = [110*52 (844-110)*52 Inf];

|

Leyfisupplýsingar:

The following choices of licensing apply to both the image and also the MATLAB code presented above.

I, the copyright holder of this work, hereby publish it under the following licenses:

This file is licensed under the Creative Commons Attribution-Share Alike 3.0 Unported, 2.5 Generic, 2.0 Generic and 1.0 Generic license.

- Þér er frjálst:

- að deila – að afrita, deila og yfirfæra verkið

- að blanda – að breyta verkinu

- Undir eftirfarandi skilmálum:

- tilvísun höfundarréttar – Þú verður að tilgreina viðurkenningu á höfundarréttindum, gefa upp tengil á notkunarleyfið og gefa til kynna ef breytingar hafa verið gerðar. Þú getur gert þetta á einhvern ásættanlegan máta, en ekki á nokkurn þann hátt sem bendi til þess að leyfisveitandinn styðji þig eða notkun þína á verkinu.

- Deila eins – Ef þú breytir, yfirfærir eða byggir á þessu efni, þá mátt þú eingöngu dreifa því verki með sama eða svipuðu leyfi og upprunalega verkið er með.

|

Gefið er leyfi til að afrita, dreifa og/eða breyta þessu skjali samkvæmt Frjálsa GNU Free Documentation License, útgáfu 1.2 eða nýrri, sem gefið er út af Frjálsu hugbúnaðarstofnuninni með engum breytingum þar á. Afrit af leyfinu er innifalið í kaflanum GNU Free Documentation License.http://www.gnu.org/copyleft/fdl.htmlGFDLGNU Free Documentation Licensetruetrue |

Þú mátt velja notkunarleyfi að eigin vali.

See also

Captions

Add a one-line explanation of what this file represents

Items portrayed in this file

depicts enska

some value

copyright status enska

copyrighted enska

copyright license enska

1. maí 2010

source of file enska

Breytingaskrá skjals

Smelltu á dagsetningu eða tímasetningu til að sjá hvernig hún leit þá út.

| Dagsetning/Tími | Smámynd | Víddir | Notandi | Athugasemd | |

|---|---|---|---|---|---|

| núverandi | 2. maí 2010 kl. 00:25 |  | 512 × 384 (220 KB) | Splash | updated for tax year 2010-11 |

Skráartenglar

Eftirfarandi síða notar þessa skrá: